Published on 17 November 2021

Heat Domes to Hurricanes: Extreme Weather Intensifies

Published on 17 November 2021

How is the insurance industry reacting to the rise in extreme weather events?

If you wanted an example of a year that illustrates the threats posed by extreme weather, you’d do no better than 2021.

In February, an extreme cold wave brought Arctic weather conditions to much of Canada, the US, and even parts of northern Mexico.

In Texas, freezing conditions paralyzed coal, gas and wind energy infrastructure, leading to power cuts that affected at least ten million people and added to a death toll of just under 300.

June saw the other extreme: a “heat dome” that hung over much of north-western Canada and the western US for six days. Temperatures were the highest ever recorded in Canada (121.3F/ 49.6C) and new records were set across seven US states. The event caused huge disruption and contributed to around 1,500 deaths across the west of North America.

Wildfires ignited and spread across the country, wiping out crops, properties and anything else that stood in their paths. While toxic particulates blew across the country, plaguing people’s lungs and other vital organs.

v Meanwhile, September’s Hurricane Ida was the most destructive of many hurricanes and storms to crash into the southern and eastern US in 2021. Ida brought winds of over 150mph to the Louisiana coast, before turning north-east and leaving a trail of destruction of deadly floods in New York City and New Jersey.

Extremes become the norm

Events like these are supposedly one in 100, or even one in 1,000-year events. Yet they appear to be happening more frequently, with the effects of climate change now cited by scientists as the key contributor.

The UN’s Intergovernmental Panel on Climate Change (IPCC) August 2021 report predicts an increase in the frequency of extreme weather events during the next 30 years. In September 2021 the American Association for the Advancement of Science published a report on the stratospheric polar vortex that suggests climate change has made extreme cold events such as the February freeze likely to happen more frequently.

Extreme weather wipes out homes, businesses and millions of lives and comes at a huge financial cost. For example, the 2020 Mid-West Derecho destroyed crops, buildings and infrastructure across 5 mid-west states, causing around $11 billion’s worth of damage in only 24 hours.

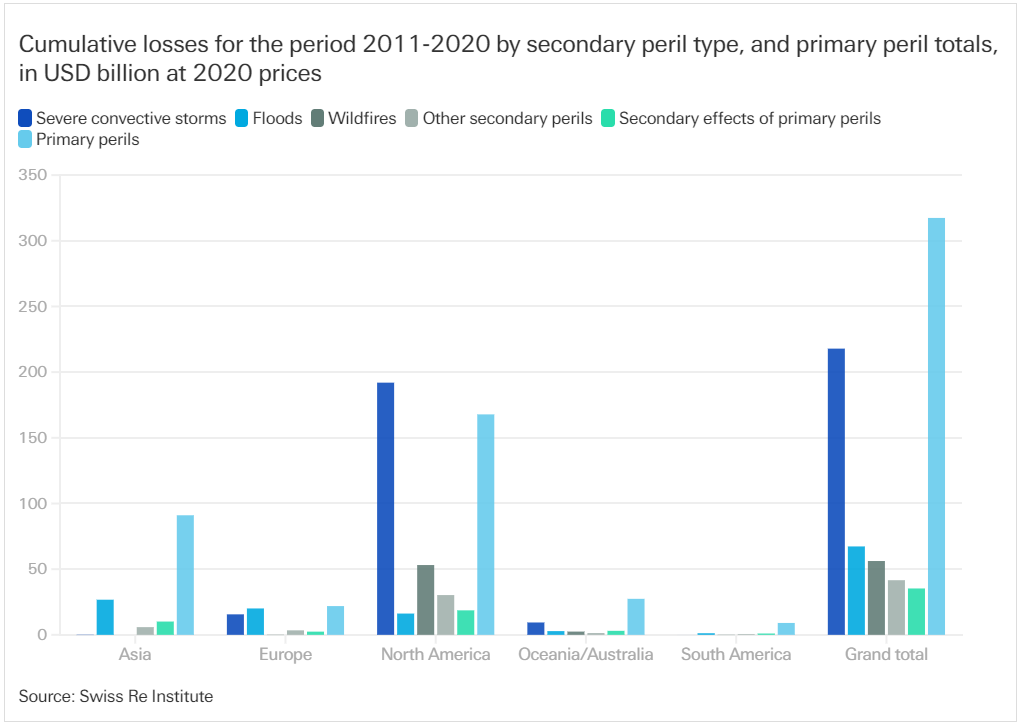

But much of the financial damage is often not a direct result of the initial catastrophe, but of secondary perils: higher frequency, low-to-medium severity events like wildfires, further storms, floods, droughts and landslides. In 2020 these events generated 70% of insured natural catastrophe losses, according to Swiss Re sigma research. Swiss Re Institute data also shows that cumulative losses from both primary and secondary perils between 2011 and 2020 were higher in North America than in any other continent.

In locations prone to extreme weather, insurance is becoming prohibitively expensive. For example, in Florida, about two-thirds of the population live in properties close to the coast, much of which is low-lying and vulnerable to flooding. Analysis from KatRisk, based on US Army Corp of Engineers (USACE) data, suggests that as extreme weather events become more likely, the financial costs to real estate in affected parts of Florida will increase from about $35 billion for a once in 100-year event today to at least $50 billion by 2050. And the cost of average annual premiums could increase by 50%, with bigger increases for the highest risk properties.

Stronger Forecasting

Rapidly increasing insurance costs are a problem for property and business owners but may also have negative impacts on insurers and brokers, exposing them to reputational and regulatory risks. Clearly it would be preferable to find ways to mitigate the risks posed by extreme weather and associated secondary perils – and to improve the chances of finding cover at a reasonable price.

One way to do this is to improve weather forecasting. Modelling weather patterns more than a few days or weeks into the future is still extremely difficult, but technologies and techniques for doing so are improving. Temperature, ocean and atmospheric data, gathered from sources including high resolution satellite imaging and remote sensors in multiple locations, can be fed into big data analytics, machine learning-based tools and catastrophe modelling software. Some of the latter may also be integrated with geospatial analytics to provide detailed information about specific risks and locations.

Risk managers can then get real-time risk information direct to their dashboards. Alesco has partnered with software provider Eigen Prism on its modelling tool Prism that allows large corporates to evaluate exposures to natural catastrophe risks in real time. Using historic data, the tool is helping us predict how catastrophic events could affect a client’s property portfolio.

A Multi-Layered Approach

With all this new data and technology at our fingertips, brokers can be more aligned in their conversations with underwriters. This is particularly important for those risks that are harder to place. We’re able to translate data into meaningful risk information and provide more informed and detailed risk proposals when we go to market. It means we can be a better advocate for clients and have a stronger say in finding them the right coverage, and at the best possible price.

Brokers can also connect clients with parametric insurance products. These insurances trigger predetermined loss payments automatically when specific events occur and can pay out even if a client isn’t directly impacted. For example, a category four hurricane might not cause physical damage to a client’s building but can still disrupt local transport and infrastructure, which can dramatically hinder their operation. Parametric policies will trigger for these types of scenarios.

There’s also consultancy work brokers and insurers can do directly with clients, like analysing their exposures to business interruption risks linked to extreme weather or other natural catastrophes. These approaches can inform other risk services a broker might be able to offer clients, such as helping with due diligence processes.

Government-backed pooling arrangements will also play a bigger role in placing some extreme weather-related risks in future. The National Flood Insurance Program (NFIP), managed and underwritten by FEMA, already delivers flood insurance to more than 5 million policyholders across the US, via a network of insurance companies. It recently revised its pricing methodology using new modelling to map flood risks for specific properties more accurately, and now claims that 23% of policyholders (about 1 million customers) will see their premiums fall as a result.

Collaboration for a Common Cause

Extreme weather events will continue to bring destruction and financial losses to the insurance industry and its clients in the future. But insurers, reinsurers, brokers and their clients will all benefit from stronger working relationships, which will facilitate improved processes for gathering, analysing and sharing risk data and information.

At the heart of that collaboration are more meaningful exchanges of information between brokers and underwriters that will inform decisions on placing and pricing insurance. The industry must continue to work with technology providers, government agencies and other partners, to develop effective, innovative solutions that can be used to manage the dangerous risks associated with extreme weather and climate change.